36 short call payoff diagram

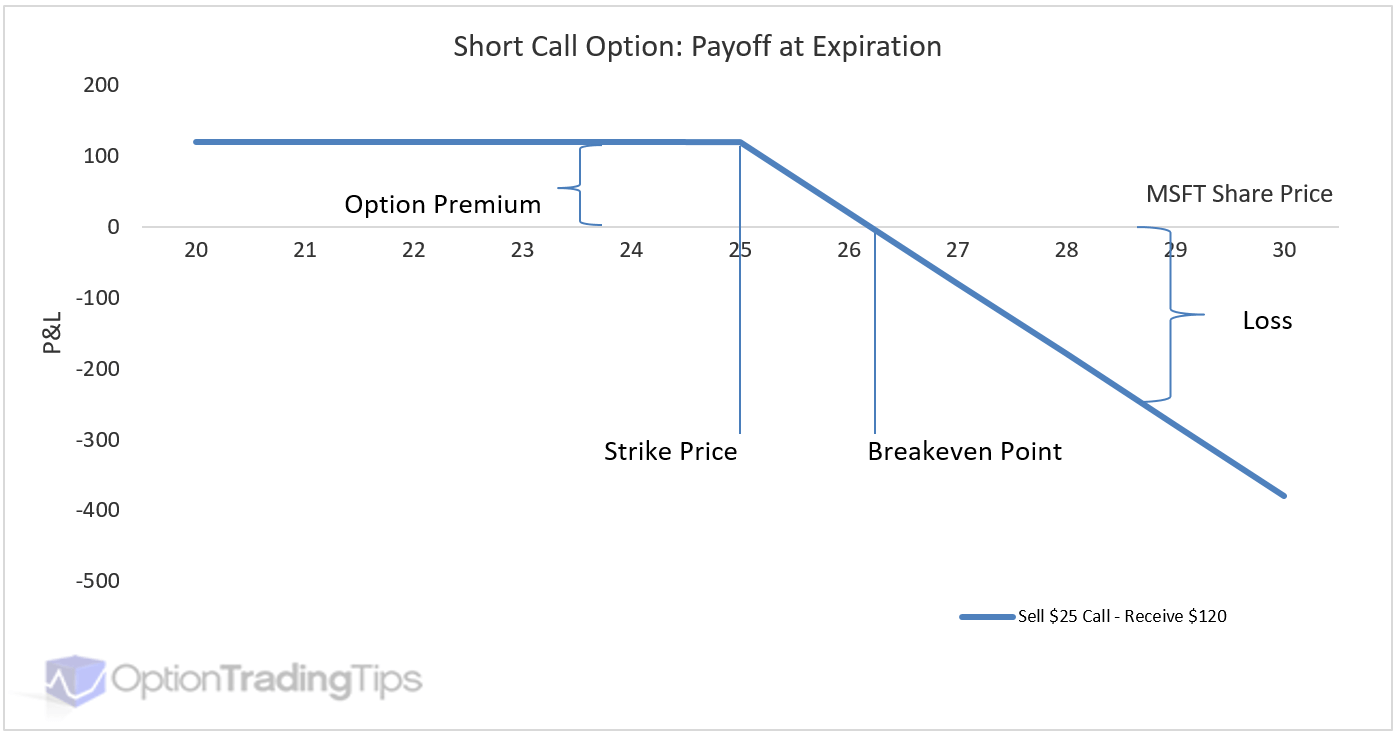

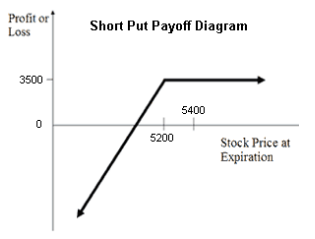

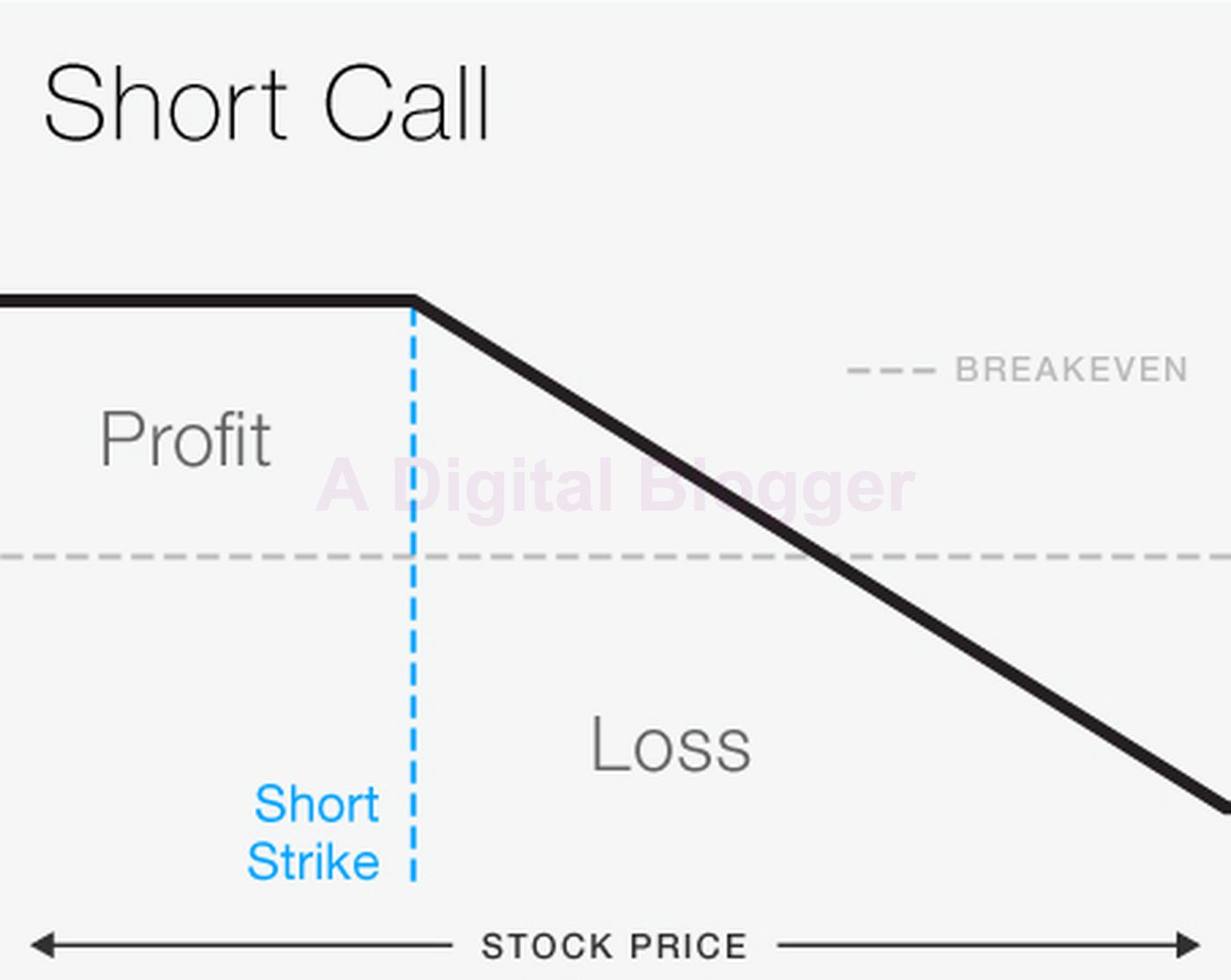

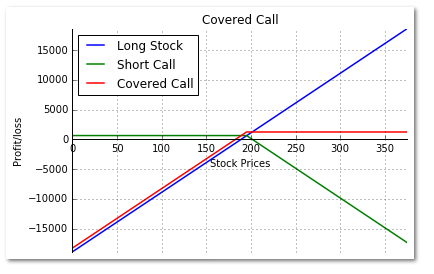

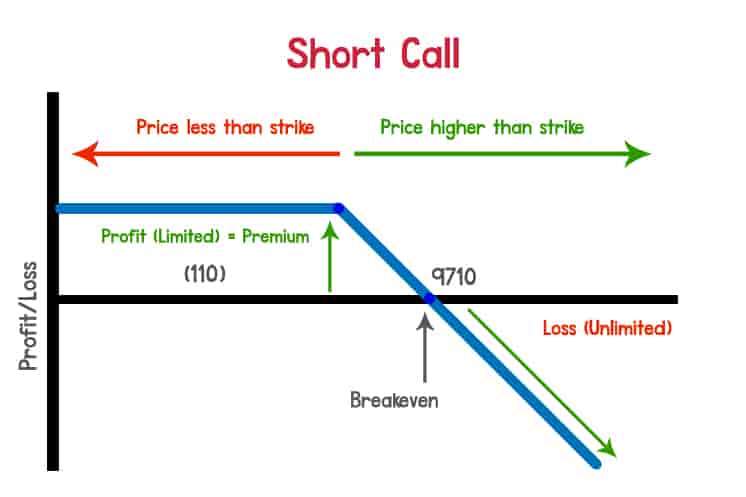

Understanding Option Payoff Charts Selling a Call Payoff. When we reverse the position and sell a call option, here is the payoff diagram for that. We have the same format of stock price on the x-axis (horizontal) and P&L on the y-axis (vertical). Because we sold the call, we receive money for the sale, which is the premium. If the shares trade anywhere below $25 then we keep ... Short put formula and payoff explained. Put option graph ... Short put: sellers of put options hope the stock price to go up or stay around current levels.If the asset price decreases, options sellers are obliged to buy shares at a predetermined price (strike). A seller of a put option receives a premium, that is, the profit potential is limited and known in advance, while risks are conditionally unlimited.

LookWAYup definition of - senses, usage, synonyms, thesaurus. Online Dictionaries: Definition of Options|Tips

Short call payoff diagram

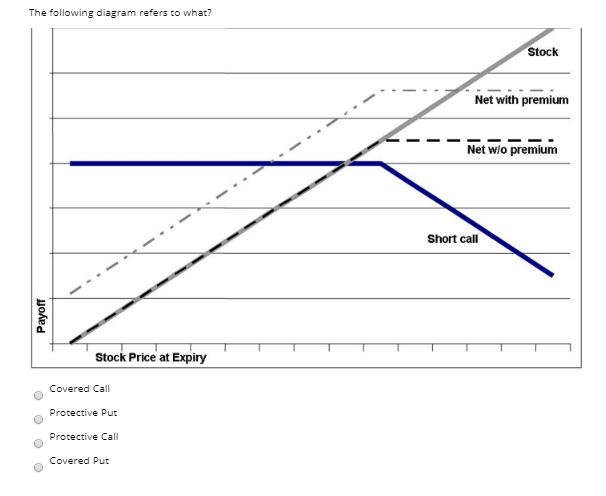

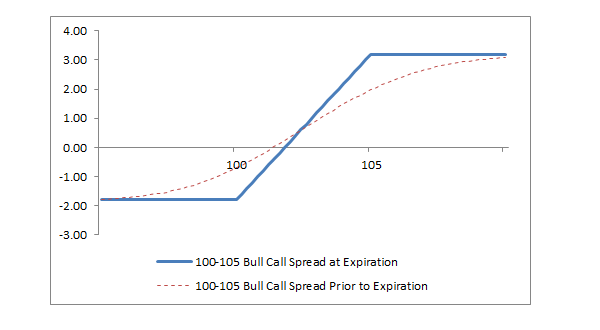

Solved Draw a payoff diagram of a portfolio consisting of ... Draw a payoff diagram of a portfolio consisting of a long call with strike price K and a short call with strike price K' > K (both written on the same underlying stock). Is the cost of the portfolio positive, negative, or zero? Explain. Draw a diagram showing the profit of the portfolio as a function of the underlying stock. 30 advertisement case studies and design tips - Learn Since this call is accompanied by such a clever graphic and concept, it is kept simple and direct and a main focal point of the page. A lot of other ads may lower the hierarchy of their calls to action so that they are small, almost subliminal type. But, if your call to action is a part of your key message, don’t be afraid to make it big, make it bold, and put it in the forefront. Call payoff diagram (video) - Khan Academy A call payoff diagram is a way of visualizing the value of a call option at expiration based on the value of the underlying stock. Learn how to create and interpret call payoff diagrams in this video. Created by Sal Khan.

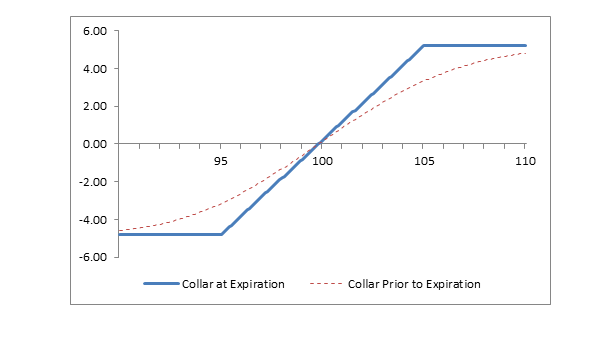

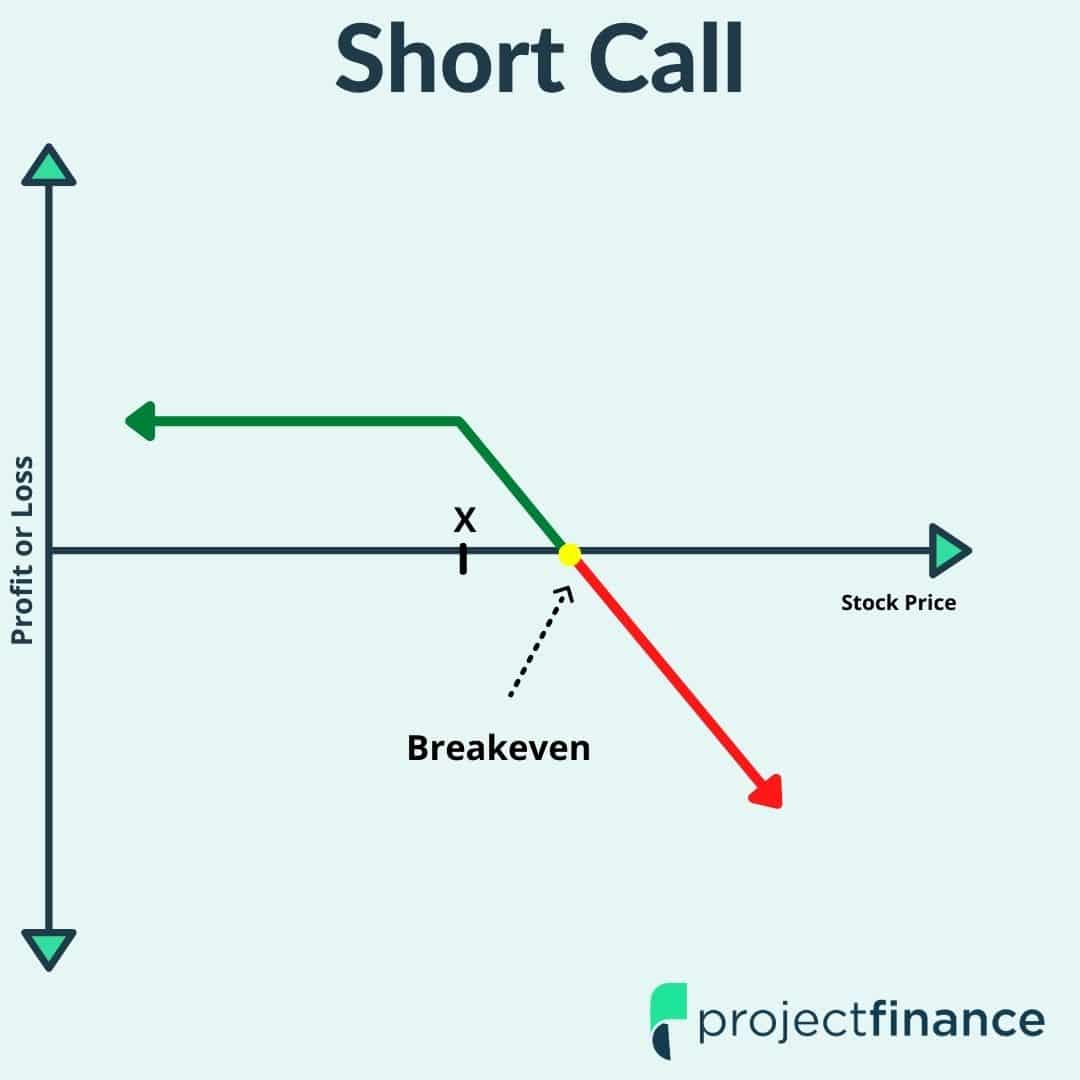

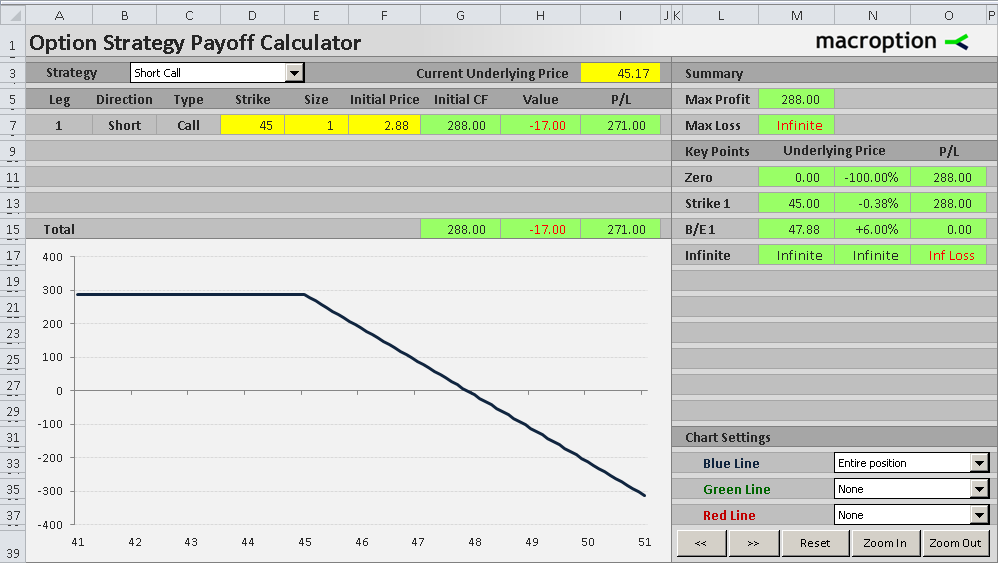

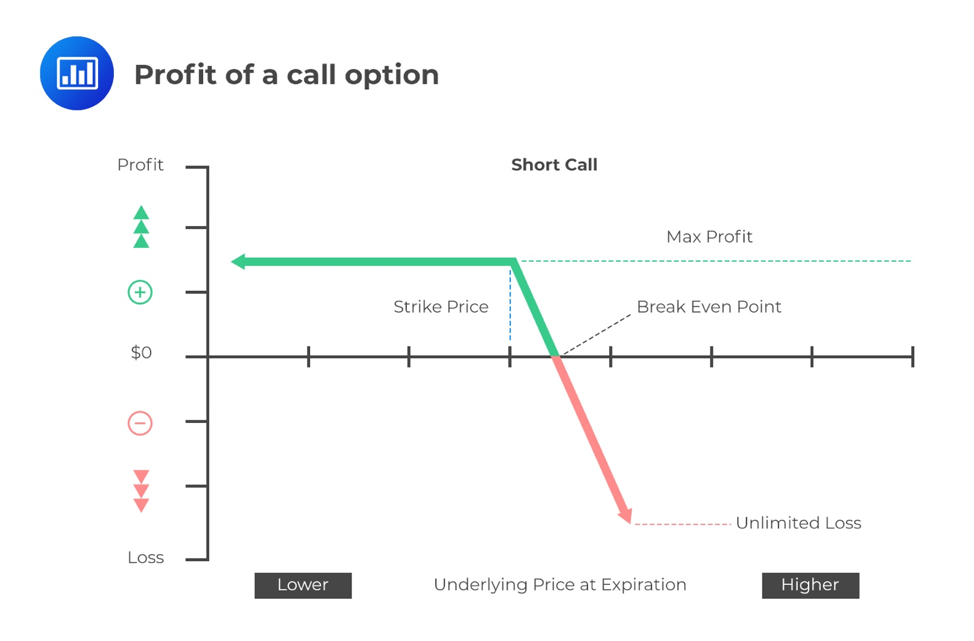

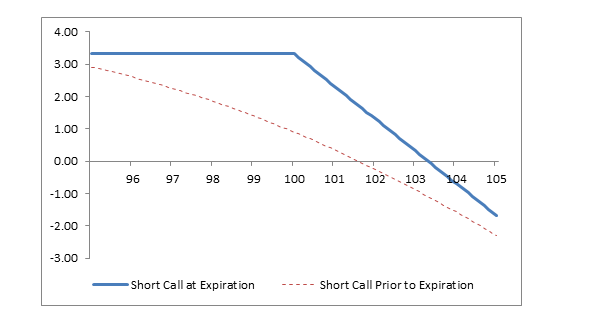

Short call payoff diagram. Options Collar Guide [Setup, Entry, Adjustments, Exit] The collar strategy payoff diagram has a defined maximum profit and loss. Shares of the underlying asset may be sold at the short call strike price or the long put strike price if the option is in-the-money at expiration. If the stock is between the two levels at expiration, both the call and put options will expire worthless. Short Call Options Strategy (Awesome Guide w/ Examples) Payoff Diagram. Short calls have a similar shaped payoff diagram to a long put. Profits are flat below the strike price with a breakeven price equal to the strike price plus the premium. Above the breakeven price, losses accrue on a one to one basis with a move higher in the stock price. Short Call Strategy Guide [Setup, Entry, Adjustments, Exit] A synthetic short call combines short stock with a short put option at the strike price of the original short stock position. This creates a synthetic short call because the payoff diagram is similar to a single short call option. As with a naked short call, the expectation is that the underlying price will decline before expiration. Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

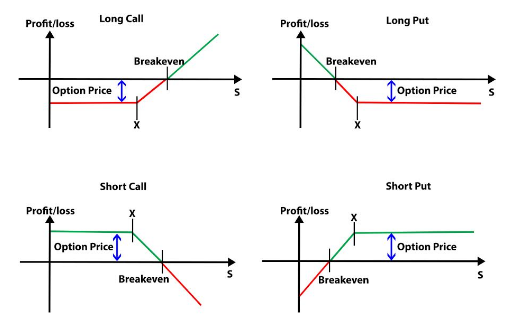

Options Payoffs and Profits (Calculations ... - AnalystPrep The payoff to the put buyer: pT = M ax(0,X -ST) = M ax(0,$26-$29) = 0 p T = M a x ( 0, X - S T) = M a x ( 0, $ 26 - $ 29) = 0. When the option has a positive payoff, it is said to be in the money. In the example above, the call option is in the money. The put option is out of the money because X -ST X - S T is less than 0. Short Call - Overview, Profits, Advantages and Disadvantages A short call is an options strategy where an investor writes (sells) a call option on a stock because he expects that stock's price to decrease in the future. Understanding the Short Call Strategy. The short call strategy creates a contract between the option writer (seller) and the option buyer (holder). Call Option Payoff Diagram, Formula and Logic - Macroption Call Option Payoff Diagram. Buying a call option is the simplest of option trades. A call option gives you the right, but not obligation, to buy the underlying security at the given strike price. Therefore a call option's intrinsic value or payoff at expiration depends on where the underlying price is relative to the call option's strike price. Call Option Profit-Loss Diagrams - Fidelity Above 41.50, or to its right on the diagram, the long call earns a profit. Note that the diagram is drawn on a per-share basis and commissions are not included. Graphing a short call. Now for the third example—a short call. Graph 3 shows the profit and loss of selling a call with a strike price of 40 for $1.50 per share, or in Wall Street ...

Call payoff diagram | Finance & Capital Markets | Khan ... Call Payoff Diagram. Created by Sal Khan.Watch the next lesson: ... Essay Fountain - Custom Essay Writing Service - 24/7 ... You only have to indicate the short deadline and our support team will help pick the best and most qualified writer in your field. The writer will confirm whether they will submit the paper within the set deadline. After confirmation, your paper will be delivered on time. Do you reuse the papers you write for clients . We never at any time reuse the papers we write for our clients. We also … How to Draw Long Call Payoff using Excel - YouTube About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features Press Copyright Contact us Creators ... Short Call Definition - investopedia.com A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security. It usually reflects a bearish outlook: an assumption that the price of ...

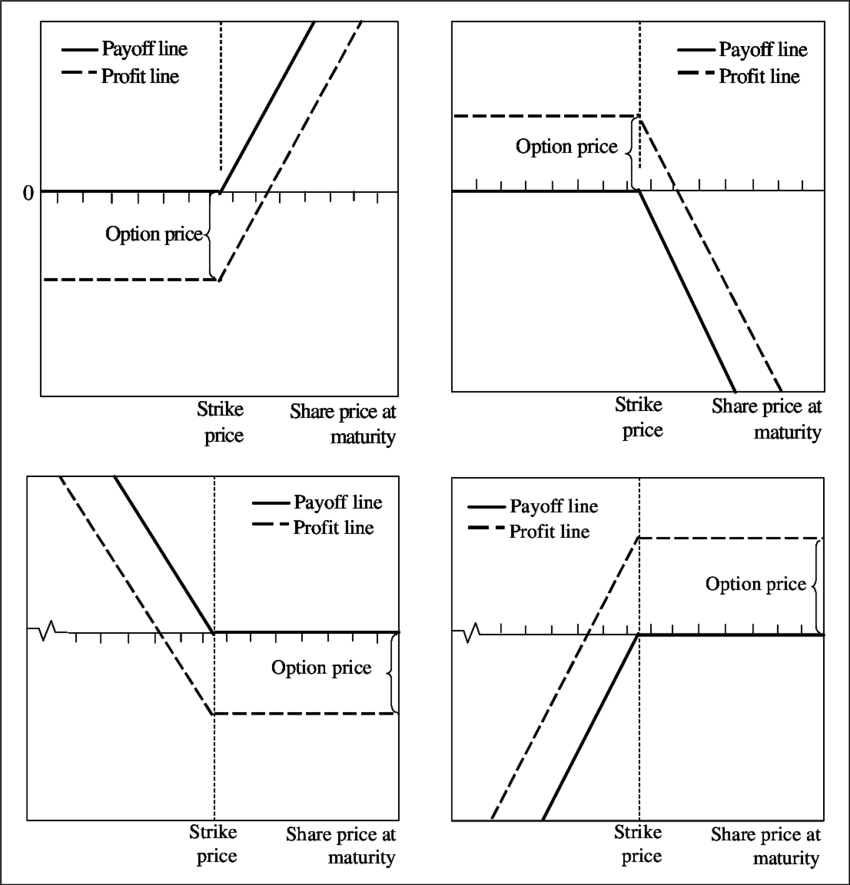

Derivatives: Pay off Diagram According to the Payoff diagram of Long Call Options strategy, it can be seen that if the underlying asset price is lower then the strike price, the call options holders lose money which is the equivalent of the premium value, but if the underlying asset price is more than the strike price and continually increasing, the holders' loss is decreasing until the underlying asset price reach the ...

Synthetic Short Call Explained | Online Option Trading Guide The formula for calculating maximum profit is given below: Max Profit = Premium Received - Commissions Paid. Max Profit Achieved When Price of Underlying <= Strike Price of Short Put. Synthetic Short Call Payoff Diagram. 0.00% Commissions Option Trading! Trade options FREE For 60 Days when you Open a New OptionsHouse Account.

Short Call Option Payoff Graph: A Beginners Guide The short call option was an AAPL 125 strike call sold for $2.60 per contract or $260 in total. The breakeven price at expiration is $127.6 (strike price plus the premium received). The blue line shows the expiration payoff that you are now familiar with and the purple line shows what is known as a "T+0" line.

Payoff Graphs vs Profit & Loss Diagrams - Overview, Examples Profit & loss diagrams are the diagrammatic representation of an options payoff, i.e., the profit gained or loss incurred on the investment made. The diagram below shows a profit and loss diagram for a "long call option.". The vertical axis indicates the profit/loss earned or incurred. All amounts above zero level represent a profit earned ...

Short Straddle - Fidelity Net credit =. 6.50. A short straddle consists of one short call and one short put. Both options have the same underlying stock, the same strike price and the same expiration date. A short straddle is established for a net credit (or net receipt) and profits if the underlying stock trades in a narrow range between the break-even points.

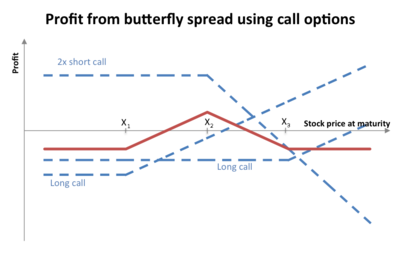

The Butterfly Payoff - luckbox magazine In the payoff diagram, a butterfly is long one 45 call, short two 50 calls and long one 55 call. It's a $5 wide butterfly strategy, meaning that the long ITM and OTM strikes are $5 away from the two short ATM options. Say an investor pays a $0.50 debit for this 45/50/500 call butterfly, and assume the stock is at $50.

Payoff Diagram for one long &one short position in Call ... 1) Portfolio 1 break-even. Draw the gross and net payoff diagrams for a portfolio which is constructed from buying one call option with a strike price $45.00 and selling one call option with a strike price of $50. The cost of the first option of $7.75 and the cost of the second option is $3.50.

Short Condor Explained | Online Option Trading Guide Max Profit Achieved When Price of Underlying = Strike Price of Lower Strike Short Call OR Price of Underlying >= Strike Price of Higher Strike Short Call. Short Condor Payoff Diagram. 0.00% Commissions Option Trading! Trade options FREE For 60 Days when you Open a New OptionsHouse Account.

Iron Butterfly Options Strategy Guide - Option Alpha Iron Butterfly Payoff Diagram. The iron butterfly gets its name from the payoff diagram, which resembles the body and wings of a butterfly. The profit and loss areas are well defined with an iron butterfly. A credit is collected when entering an iron butterfly. The initial credit received is the maximum profit potential. If the underlying price is above or below one of the long strike …

Put payoff diagram (video) - Khan Academy Put payoff diagram. Transcript. A put payoff diagram is a way of visualizing the value of a put option at expiration based on the value of the underlying stock. Learn how to create and interpret put payoff diagrams in this video. Created by Sal Khan.

Payoff diagrams | A Matter of Course - WordPress.com Short Forward: Long Call: Short Call: Long Put: Short Put: With this idea in place, we can also talk about the payoff diagram of an underlying itself w.r.t itself. This is of course trivial, because a stock is a stock is a stock, so if we buy a stock, that stock's value is just the value of the stock.

Short Call (Naked Call) Option Strategy Explained Short Call (or Naked Call) strategy involves the selling of the Call Options (or writing call option). In this strategy, a trader is Very Bearish in his market view and expects the price of the underlying asset to go down in near future. ... Your pay-off diagram is much superior to the ones usually available.I suggest if a relevant price chart ...

Payoff Diagrams for Options | Call Options | Put Options ... Payoff Diagrams for Options | Call Options | Put Options | Options Long | Short | How to Read Payoff Diagram Hi This is Ashish yadav Welcome to my Channel -...

Payoff and profit profile of a long call and short put ... Download scientific diagram | Payoff and profit profile of a long call and short put from publication: Valuing put options on single stock futures: Does the put-call parity relationship hold in ...

Short Call Payoff Diagram and Formula - Macroption Short Call Payoff Diagram. The payoff diagram of a short call position is the inverse of long call diagram, as you are taking the other side of the trade. Basically, you multiply the profit or loss by -1. For detailed explanation of the logic behind individual sections of the graph, see long call option payoff.

Call payoff diagram (video) - Khan Academy A call payoff diagram is a way of visualizing the value of a call option at expiration based on the value of the underlying stock. Learn how to create and interpret call payoff diagrams in this video. Created by Sal Khan.

30 advertisement case studies and design tips - Learn Since this call is accompanied by such a clever graphic and concept, it is kept simple and direct and a main focal point of the page. A lot of other ads may lower the hierarchy of their calls to action so that they are small, almost subliminal type. But, if your call to action is a part of your key message, don’t be afraid to make it big, make it bold, and put it in the forefront.

Solved Draw a payoff diagram of a portfolio consisting of ... Draw a payoff diagram of a portfolio consisting of a long call with strike price K and a short call with strike price K' > K (both written on the same underlying stock). Is the cost of the portfolio positive, negative, or zero? Explain. Draw a diagram showing the profit of the portfolio as a function of the underlying stock.

/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

/dotdash_Final_Short_Put_Apr_2020-01-c4073b5f97b14c928f377948c05563ef.jpg)

![Short Call Strategy Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6078aad42461f629aa893616_1038348_ShortCallsizingadjustment_041521.png)

0 Response to "36 short call payoff diagram"

Post a Comment